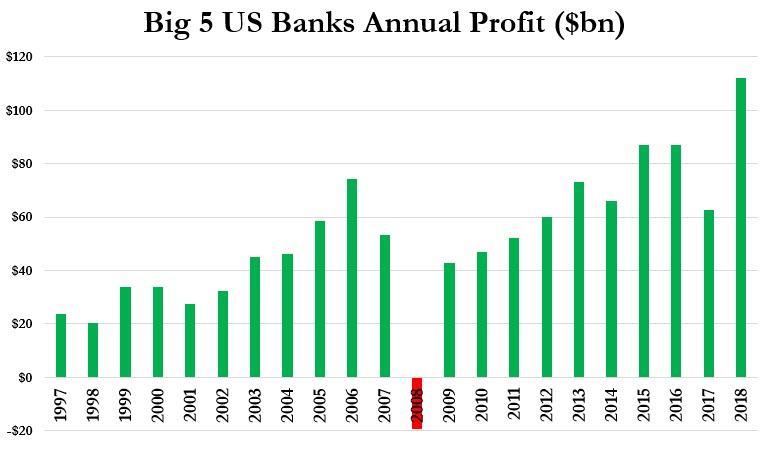

One may not know it by looking at banker bonuses last year, but 2018 was a banner year if only for bank shareholders and upper management: this is the year when the 6 biggest banks generated (well) over $100 billion in profit. They can thank Trump’s tax cuts, the Fed’s payment of interest on reserves, rising interest rates, a jump in dealmaking and a retail-banking boom (if not so much the “bad volatility” that resulted in a plunge in fixed income, currency and commodity trading fees).

As Bloomberg first noted, JPMorgan, Bank of America, Wells Fargo and their peers have already reported more than $111 billion of profit for 2018, and Morgan Stanley will complete the money-center picture tomorrow when it releases its fourth-quarter results Thursday and only makes this number bigger.

While JPMorgan and Bank of America both had record years, Goldman and Citigroup had their biggest annual profits since the financial crisis. The staggering profits, coupled with upbeat commentary about 2019 may ease fears that rate hikes and trade wars will bring an end to good times for the biggest banks.

To be sure, the banks’ bosses see not a cloud in sight: “Is it the end of a cycle? We don’t think so,” JPM CFO Marianne Lake said Tuesday. “We think the outlook for growth in the economy is still strong. The consumer is still strong and healthy, and we’re expecting to see, maybe slower, but still global growth going forward.”

Her optimism may have been a bit stretched as this quarter JPM missed earnings estimates for the first time in 15 quarters, while the bank’s provision for loan losses surged to $1.55 billion, far above the expected $1.3 billion.

Meanwhile, the question is whether or not the market already reflects the banks’ massive profits, or if there is room for bank stocks to run more: the KBW Bank Index surged 10% this month, on the back of a furious bear market rally and following generally strong fourth-quarter results; however, it comes after banks slumped into a bear market, plunging 20% in 2018, the worst performance in seven years.